CASE STUDY: Underbanked pilot

r

With nearly 55 million underbanked consumers who have a bank account but also used an alternative financial service product, the vision for this pilot was to help this customer segment become banked by creating a digital financial health tool and experience that was transformative. The focus was on helping customers improve their credit and financial situation, Wells Fargo took a decisive step towards connecting with the underbanked.

This pilot was sponsored by senior Wells Fargo community banking leadership and was inspired by the ground breaking work by American Express servicing the underbanked population.

As an experience strategist, with the community banking customer experience team, my role was to partner with the various lines of business to prototype and validate critical business and customer opportunities.

This 3 month engagement included partnering with the digital strategy group for rapid concept development and validation for financial product and services for the underbanked.

Utilizing design thinking this concept project was structured as a series of co-creative workshops that began with defining the market, problem space, customer journeys, rapid prototyping and culminated with an interactive prototype for testing and concept validation.

r

PROJECT ROLE

Experience strategy, facilitation, information architecture and interaction design

r

STRATEGY AND DESIGN DELIVERABLES

r

▸ Design workshop: Personas

▸ Design workshop: Customer journey

▸ Design workshop: Rapid prototyping

▸ Design exploration

▸ Mobile app concept user flow

▸ Mobile app interactive concept

r

PROJECT TEAM

Senior community banking leadership (Wells Fargo community banking), Digital Strategy (Wells Fargo community banking and whole sale), PFM leadership (Wells Fargo community banking), Product Management (Wells Fargo whole sale) and user research (Wells Fargo community banking customer experience).

r

PROJECT MANAGEMENT METHODOLGY

• Agile

r

r

1 Explore: Understand the project

R

The primary on this project was the digital strategy team reporting directly to the EVP of Wells Fargo community banking.

r

1A. DEFINED DECISION MAKERS

• Digital strategy: Reviewers and initial approvers

• EVP of Wells Fargo community banking: Final approver

r

1B. STAGE GATES

1. Explore: Understand the project and the customer

2. Imagine: Model the and validate the experience

r

1C. BUSINESS STRATEGY AND SUCCESS METRICS

r

Creating product and services for a net new customer segment, especially one like the Underbanked requires careful analysis of financial and organizational limitations and capabilities. The two pillars of success metrics for this pilot were:

• Offer underbanked consumers valuable, relevant and cohesive financial product and services

• Determine business, compliance impact, as well as organizational coordination and buy in.

01 EXPLORE: Understand the Customer

R

Market and customer research to gain a greater understanding of the market segments, customer challenges and opportunities.

R

1. Market and customer research

Our first design thinking workshop was focused on knowledge share and alignment around core business and customer challenges and opportunities.

r

1A. FORMAT

All day design workshop, held with 30 participants from the various lines of business and compliance at Wells Fargo that would be involved and impacted by products and services for the Underbanked.

• Consumer banking digital strategy

• Consumer banking customer experience

• Savings and loans

• Consumer deposits

• Compliance

• Agency of record for the Underbanked market research

r

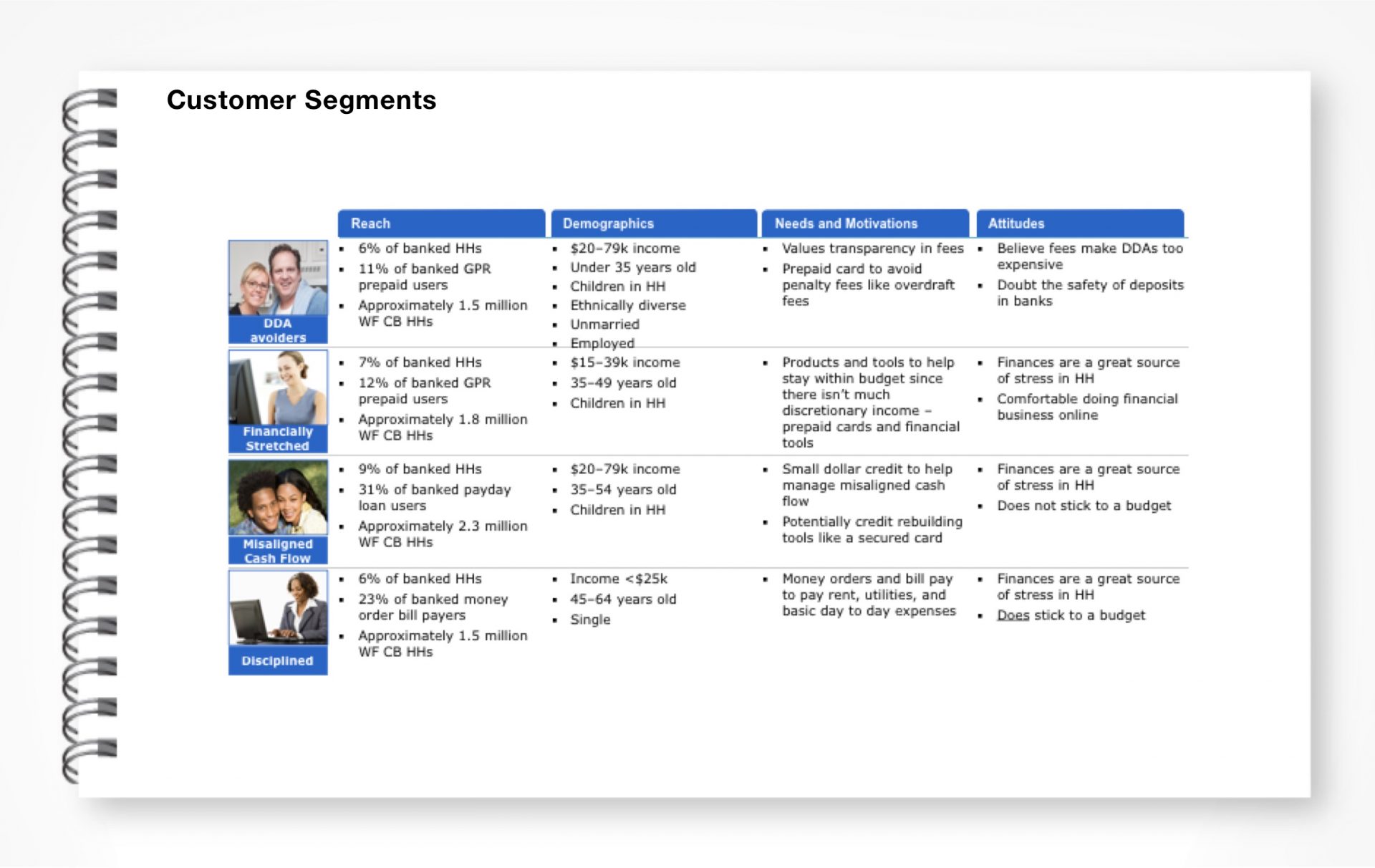

1B. CUSTOMER SEGMENTS

Drawing on market research by one of Wells Fargo marketing agency partners.

• DDA Avoiders: Millennials, focused on transparency with fee’s

• Financially stretched: Gen X and Y, focused on financial health products and services

• Misaligned Cash Flow: Gen X and Y focused on products such as secured cards or short term loans.

r

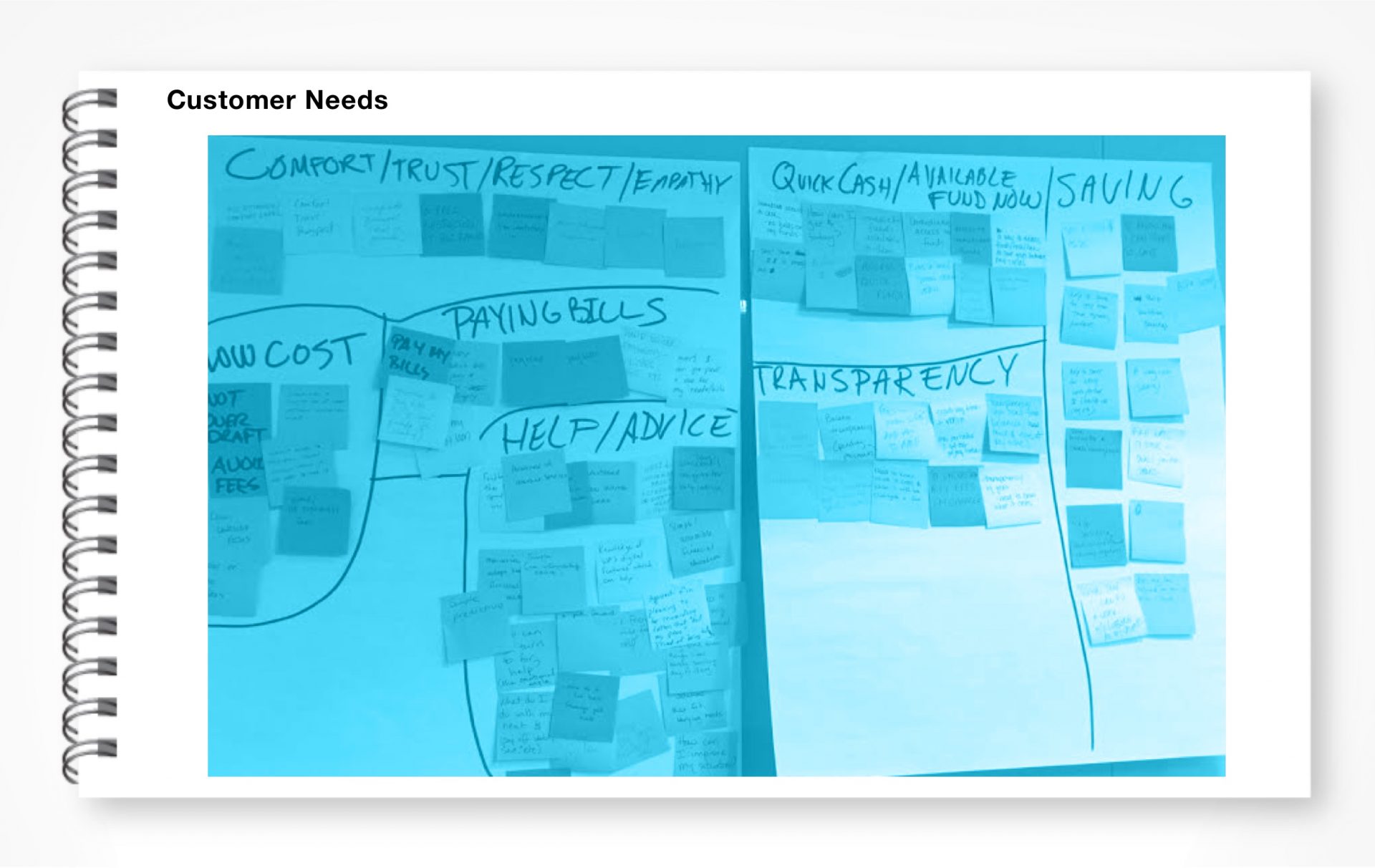

1C. CUSTOMER NEEDS AND CHALLENGES

The major challenges facing underbanked center around inconsistent pay cycles, misalignment with bills and income, as well as a lack of savings for unexpected expenses. Any financial product and service for the Underbanked would need to solve for these challenges.

• Income Volatility: get paid in irregular ways and from different sources (check, cash, pre-paid card), different times (seasonal), short and long inconsistent pay cycles

• Misalignment of Bills & Income: Income and bills come at different times and creates gap periods where there is no money to pay bills, need immediate funds but must until next pay periods and pay late fees

• No savings, or buffer to support unexpected financial needs (e.g. car broke down).

r

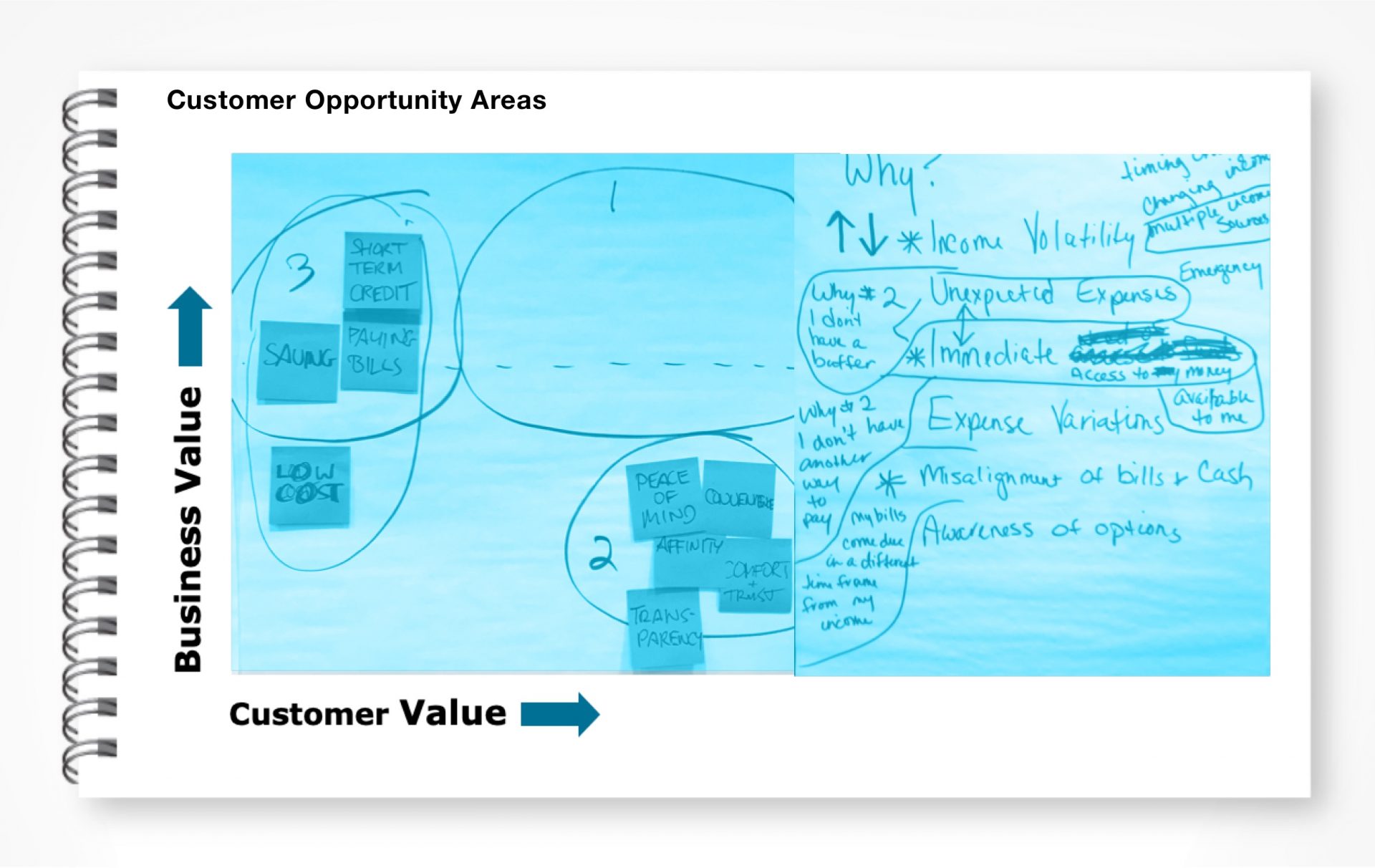

1D. CUSTOMER OPPORTUNITIES

The final exercise of the workshop was determining the key opportunity areas for our solution.

• Bridge Fund: Funds till my next pay cheque

• Affinity: Create Peace of Mind, Comfort, Confidence and Transparenc

• Short Term Credit: Life Events

r

1E. NEXT STEPS

The next step and workshop was focused on mapping the market research insights to the Wells Fargo Enterprise personas and creating customer journeys for the Underbanked.

R

R

2. Personas and Customer Journeys

R

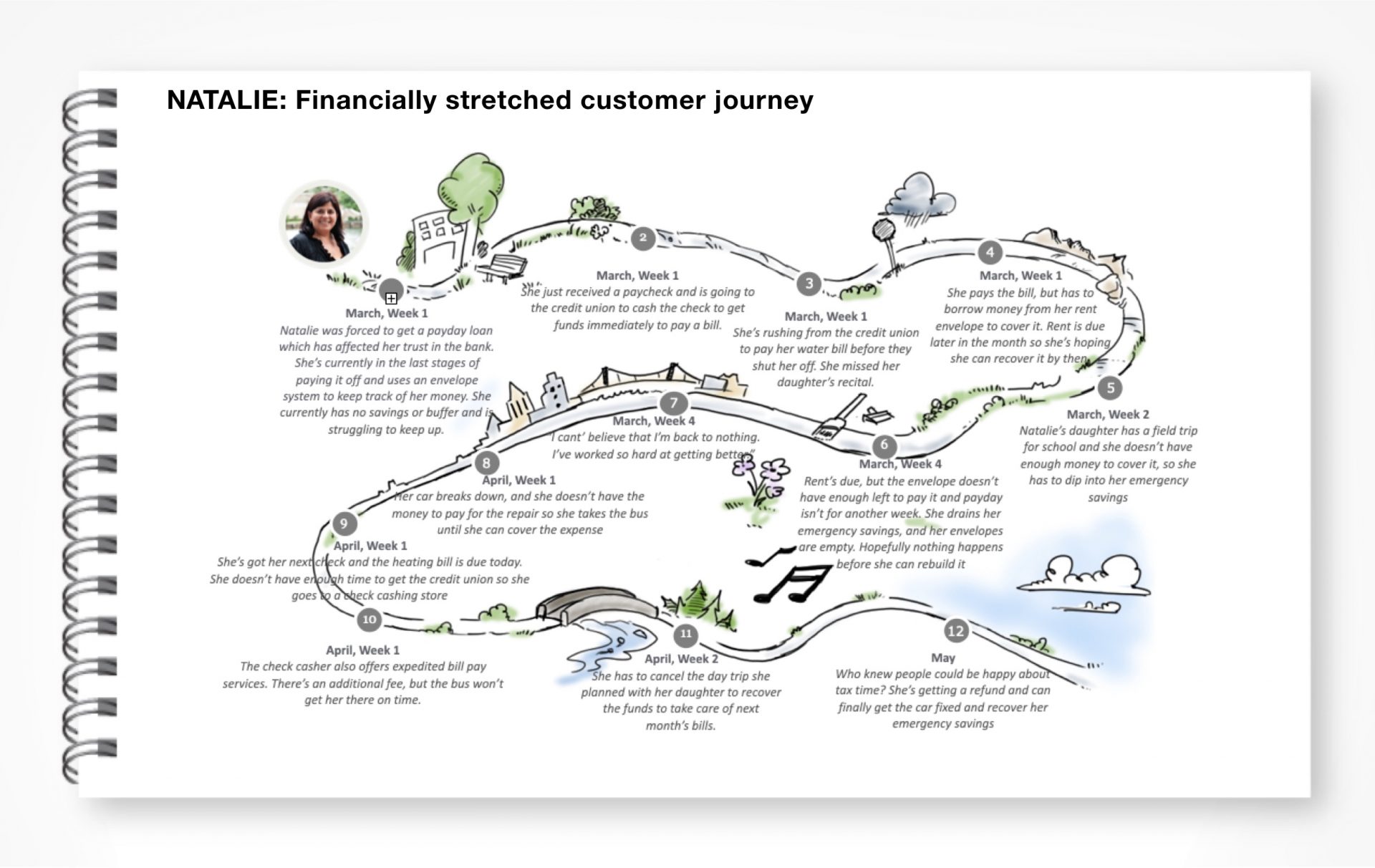

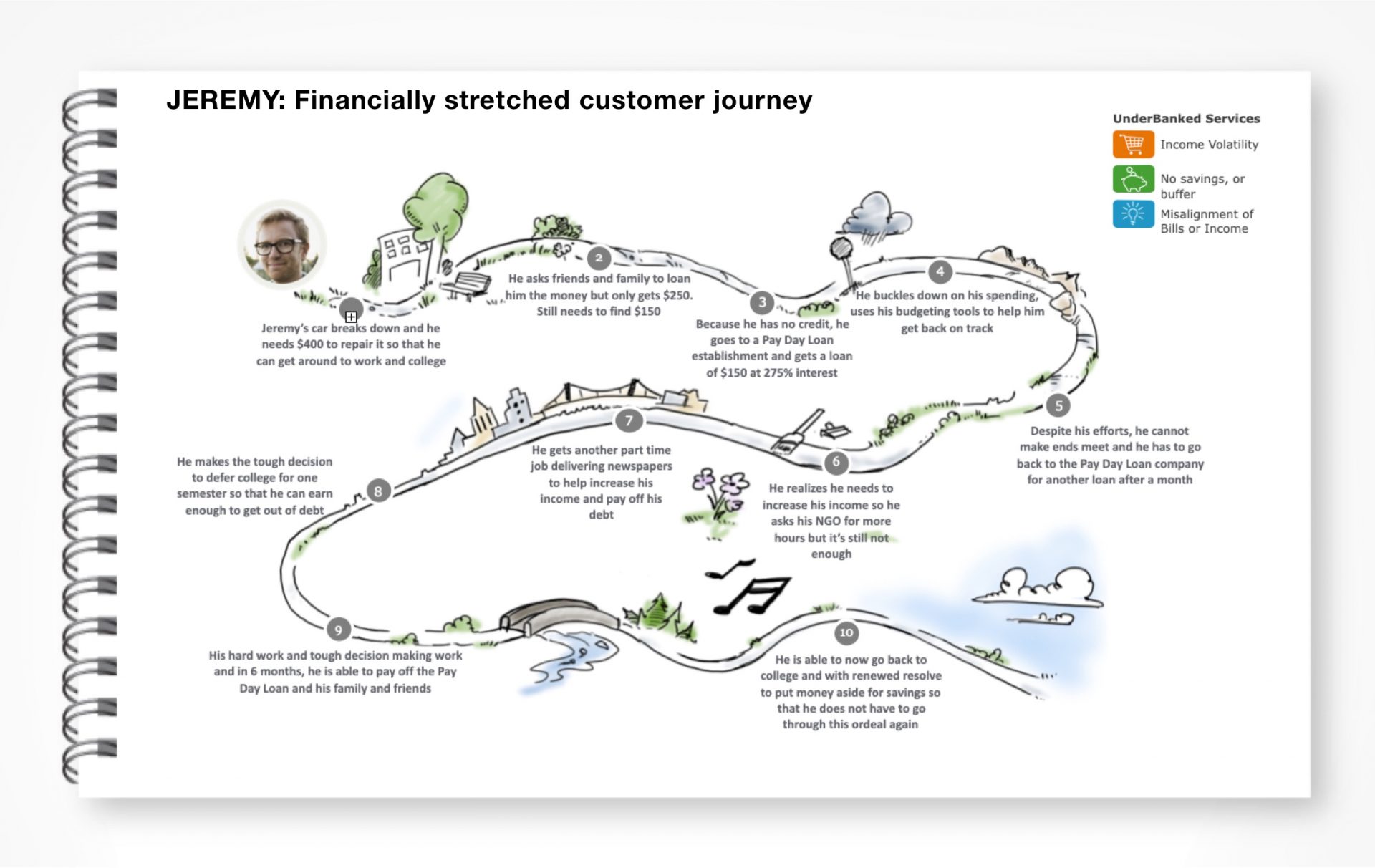

Once we had established the customers segments, needs, challenges and opportunities, we were ready for our second workshop, focused on defining the Underbanked personas and customer journeys to define the primary and secondary target audience, mental models, priorities and context.

r

2A. FORMAT

All day workshop, held with 25 participants from the various lines of business and compliance at Wells Fargo that would be involved and impacted by products and services for the Underbanked.

• Consumer banking digital strategy

• Consumer banking customer experience

• Savings and loans

• Consumer deposits

• Compliance

• Agency of record for the Underbanked market research

r

2B. WELLS FARGO ENTERPRISE PERSONAS

Part of the pre work for this workshop included initial validation with the core project team if the Wells Fargo enterprise persona’s could be mapped to the Underbanked. Once we established that they could be extended to this customer segment we presented this to the entire project team as a baseline for the Underbanked persona definition.

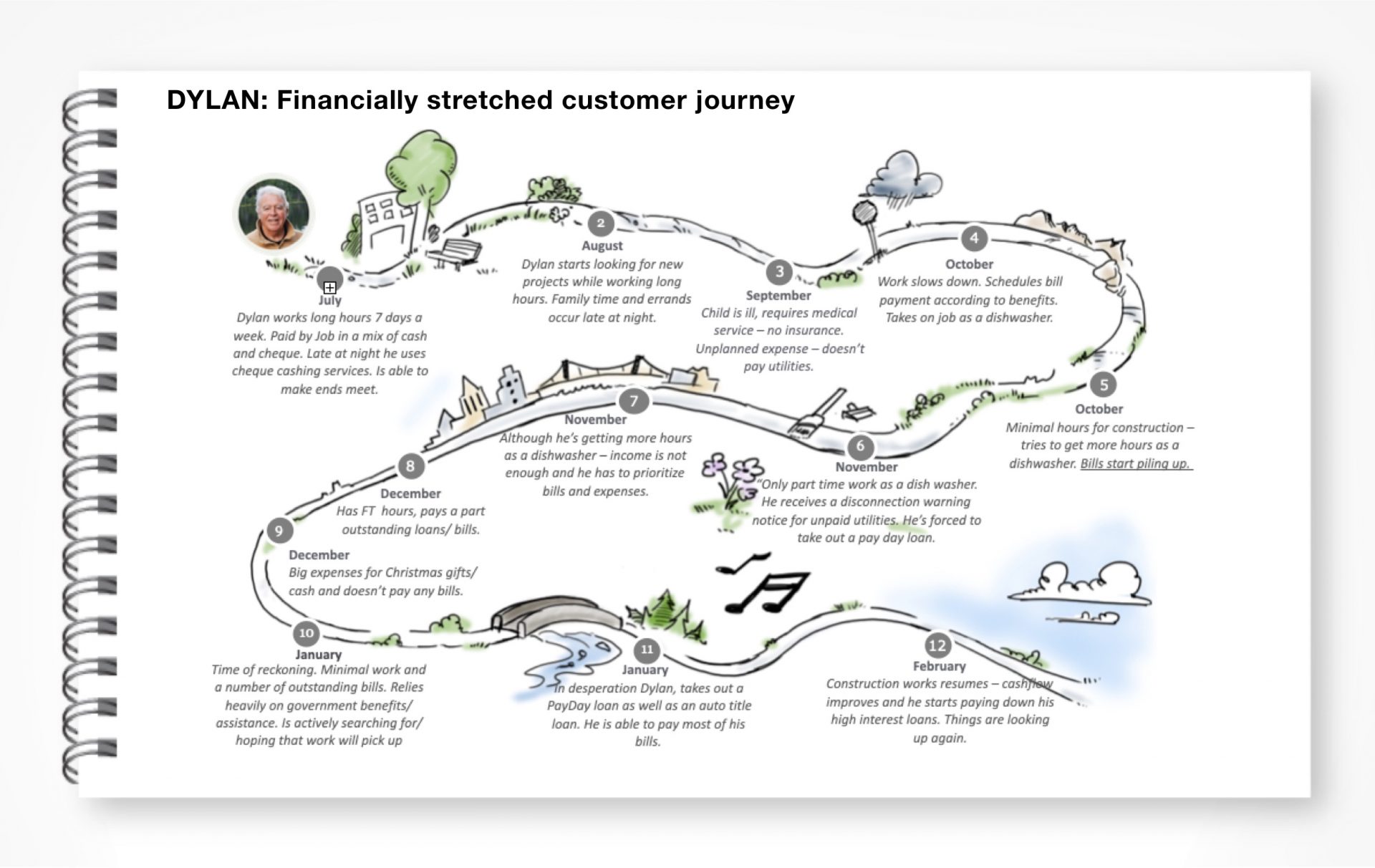

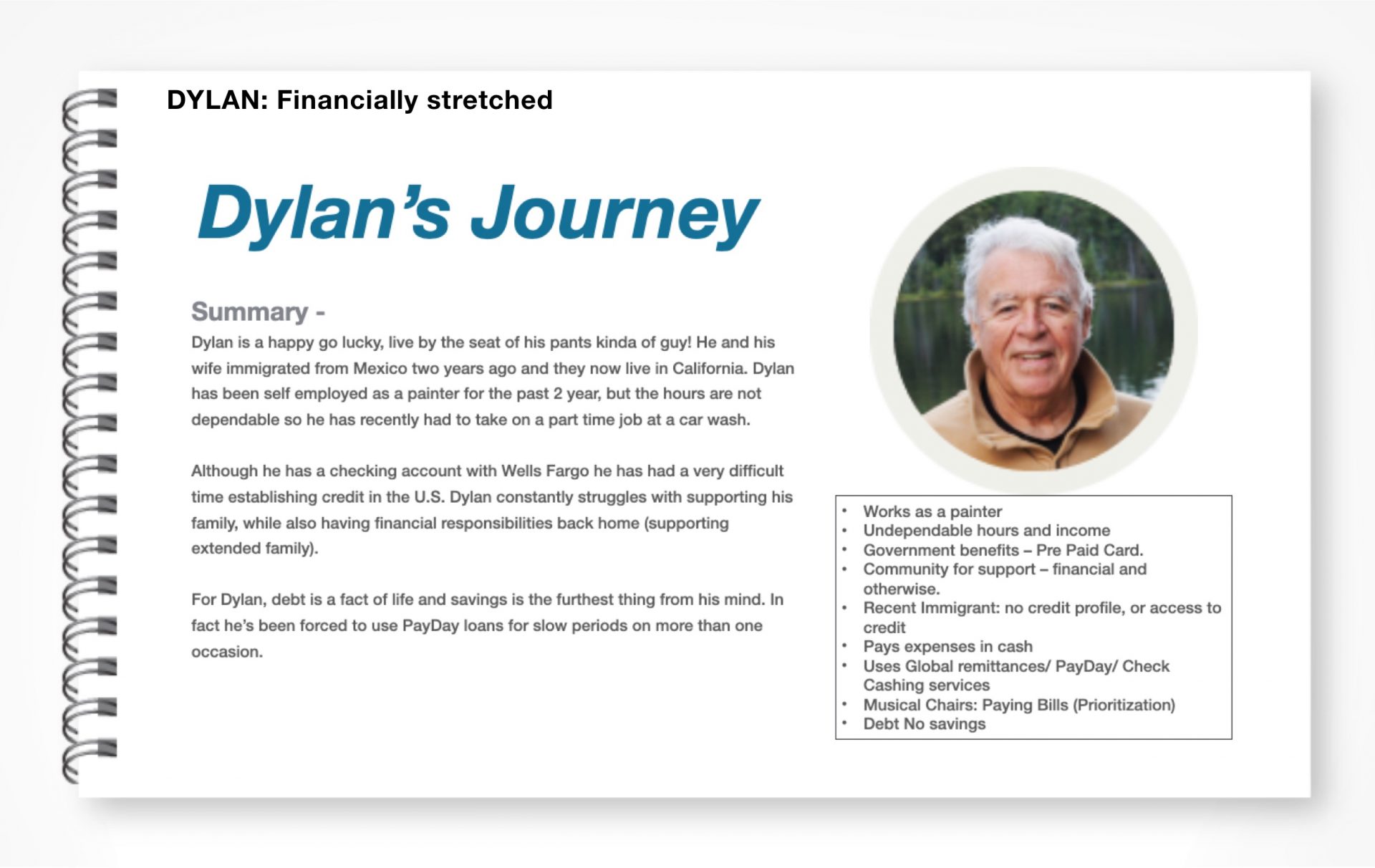

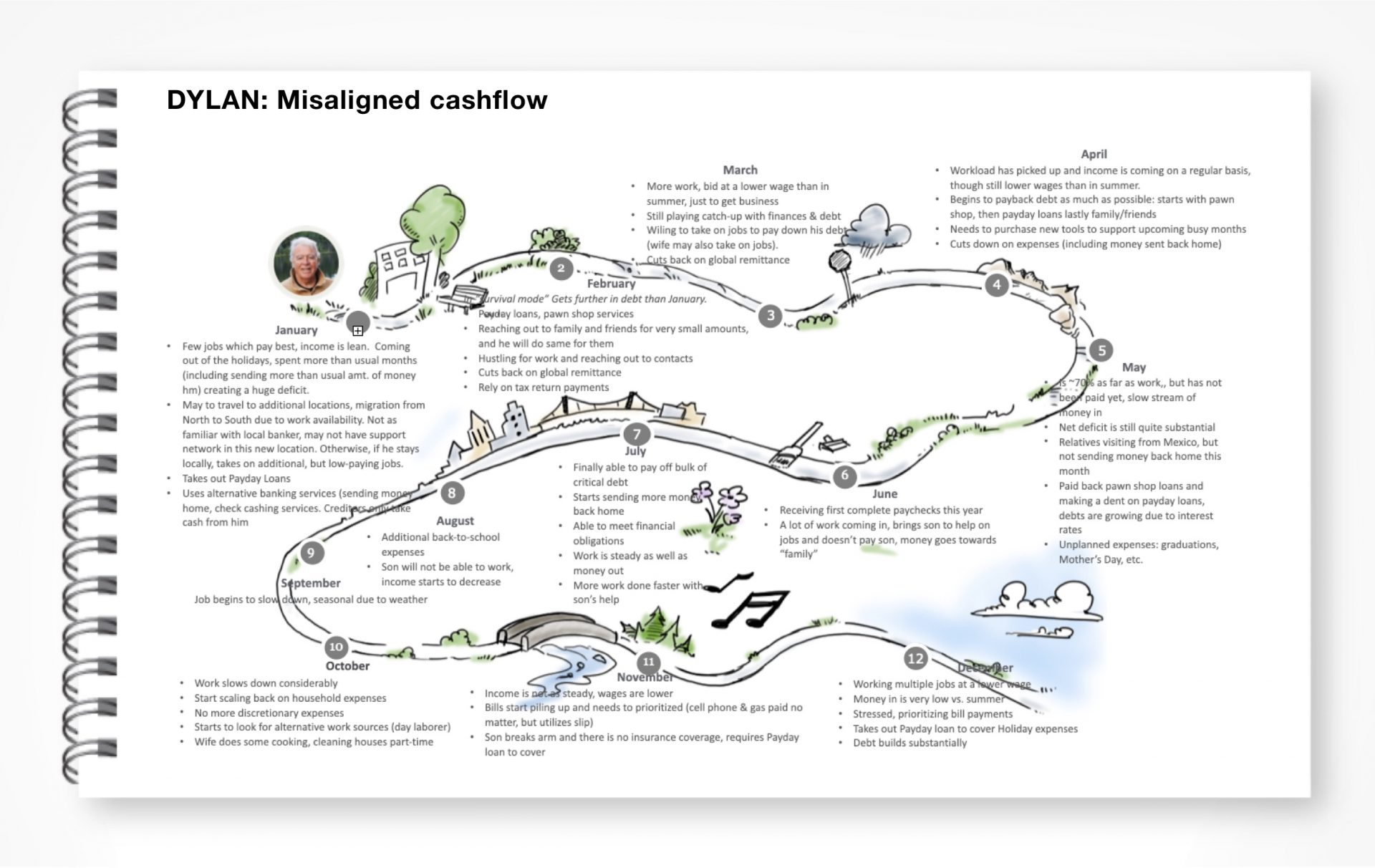

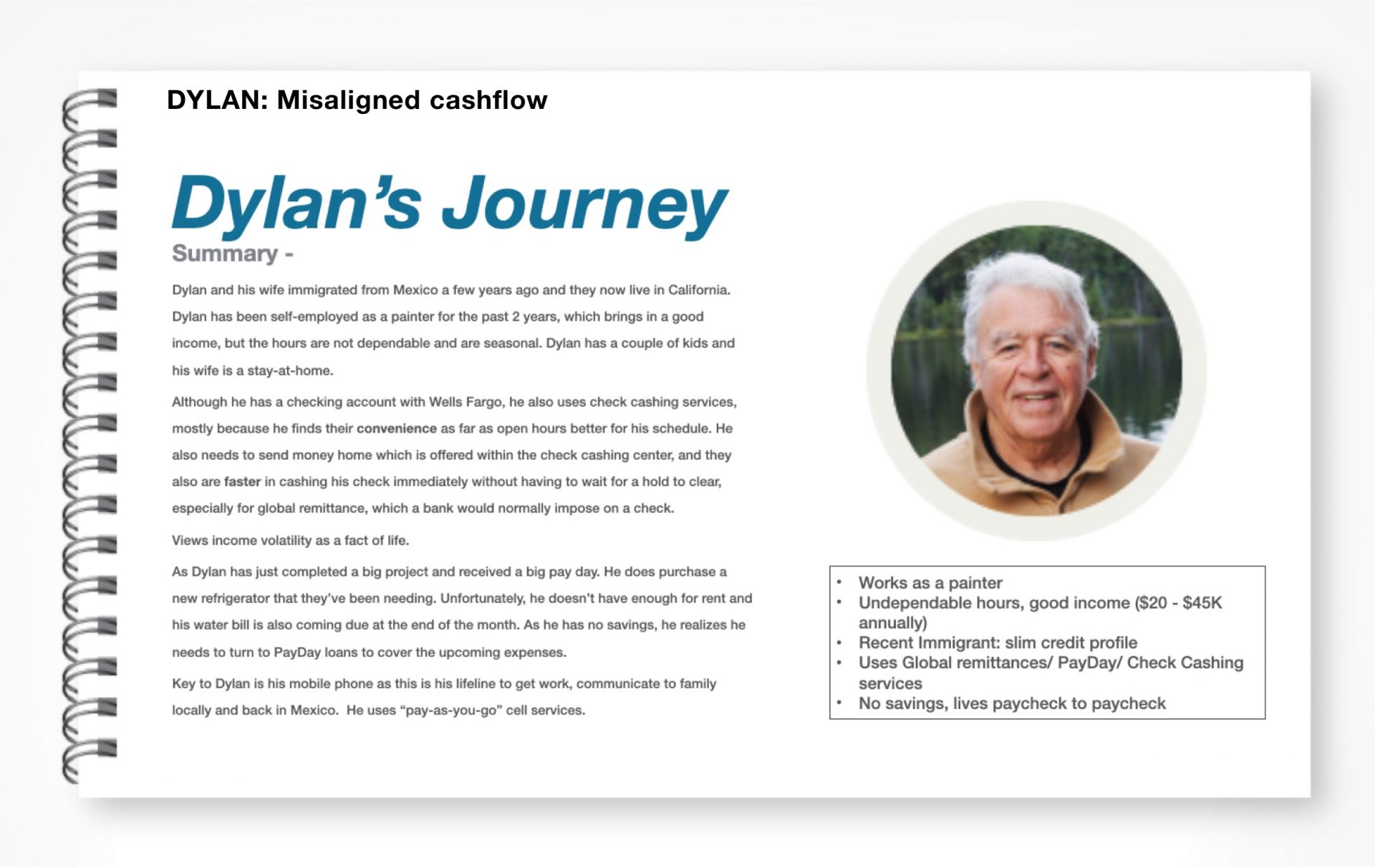

• Dylan: Lives in the moment, requires hand holding and help to develop financial literacy and health

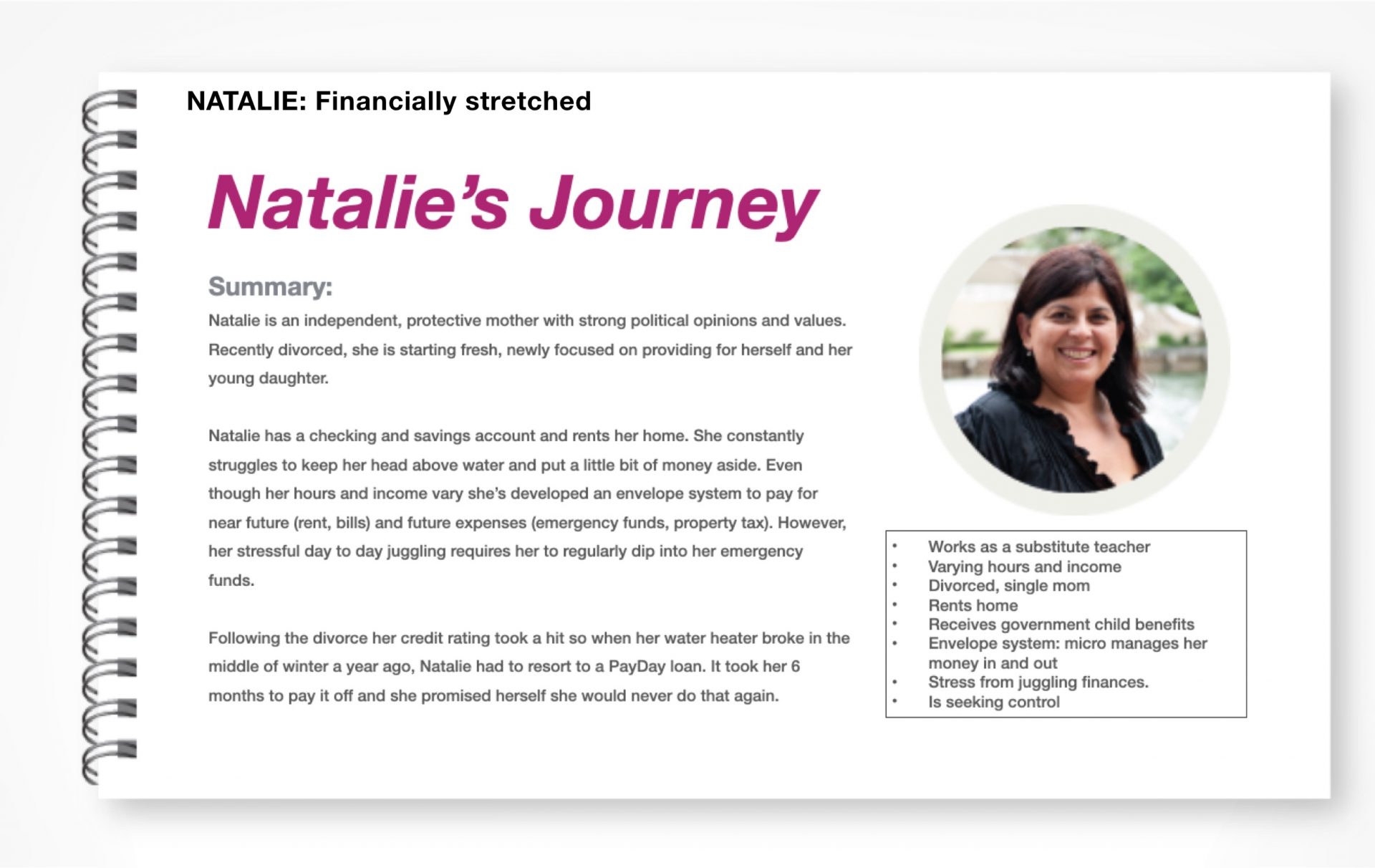

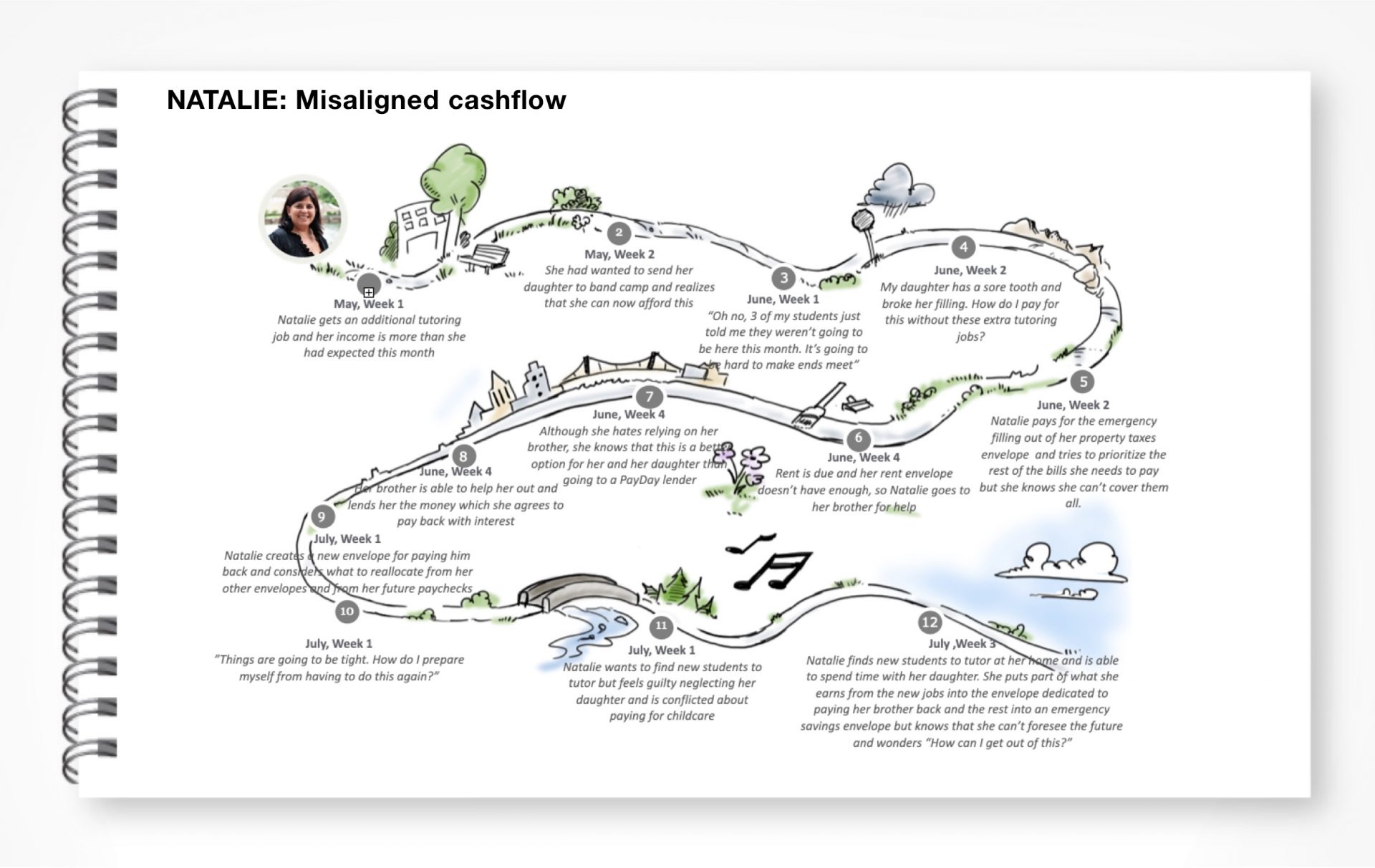

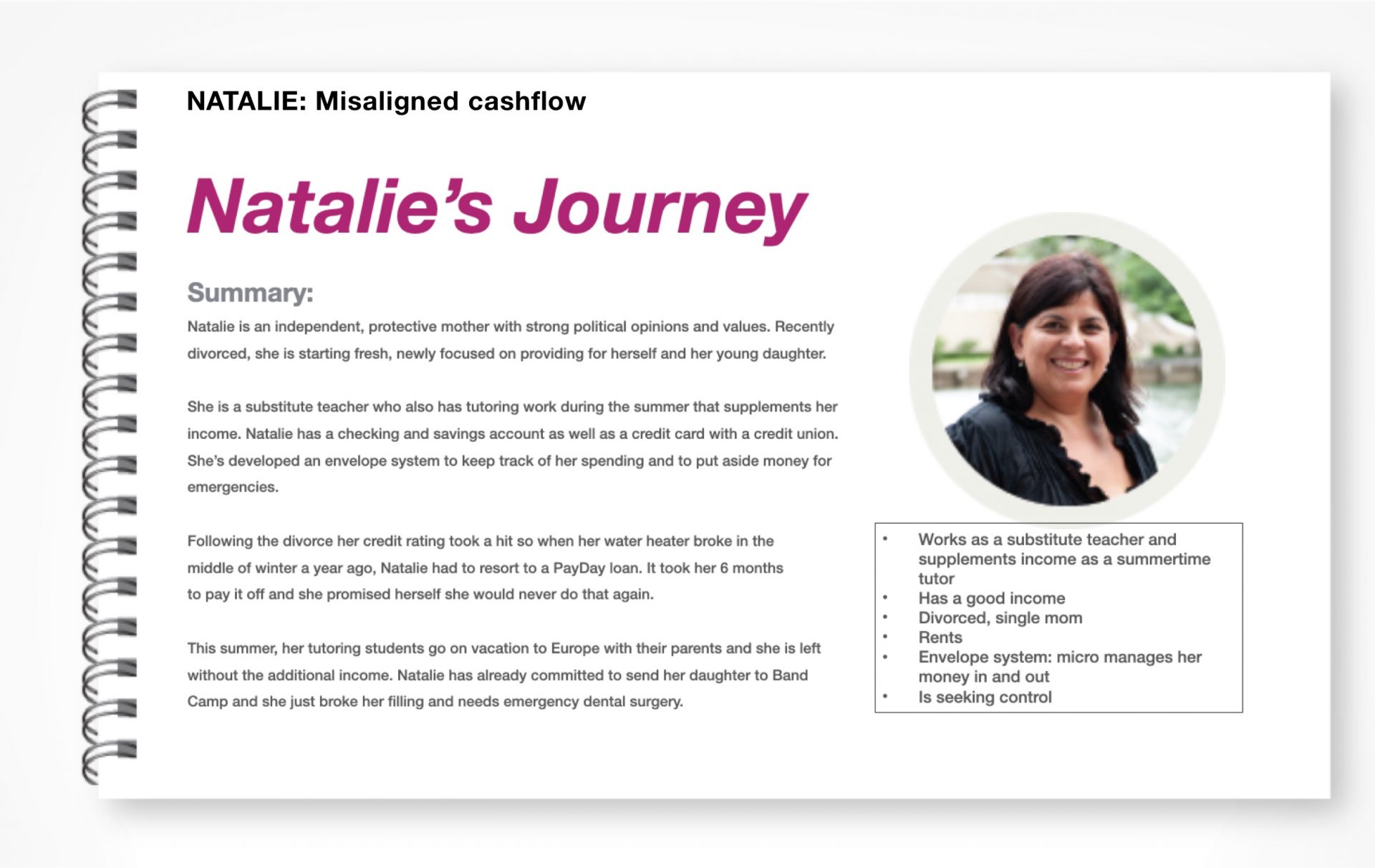

• Natalie: The awakened. Faced with life events finances have taken a hit, requires credit and PFM tools for financial health

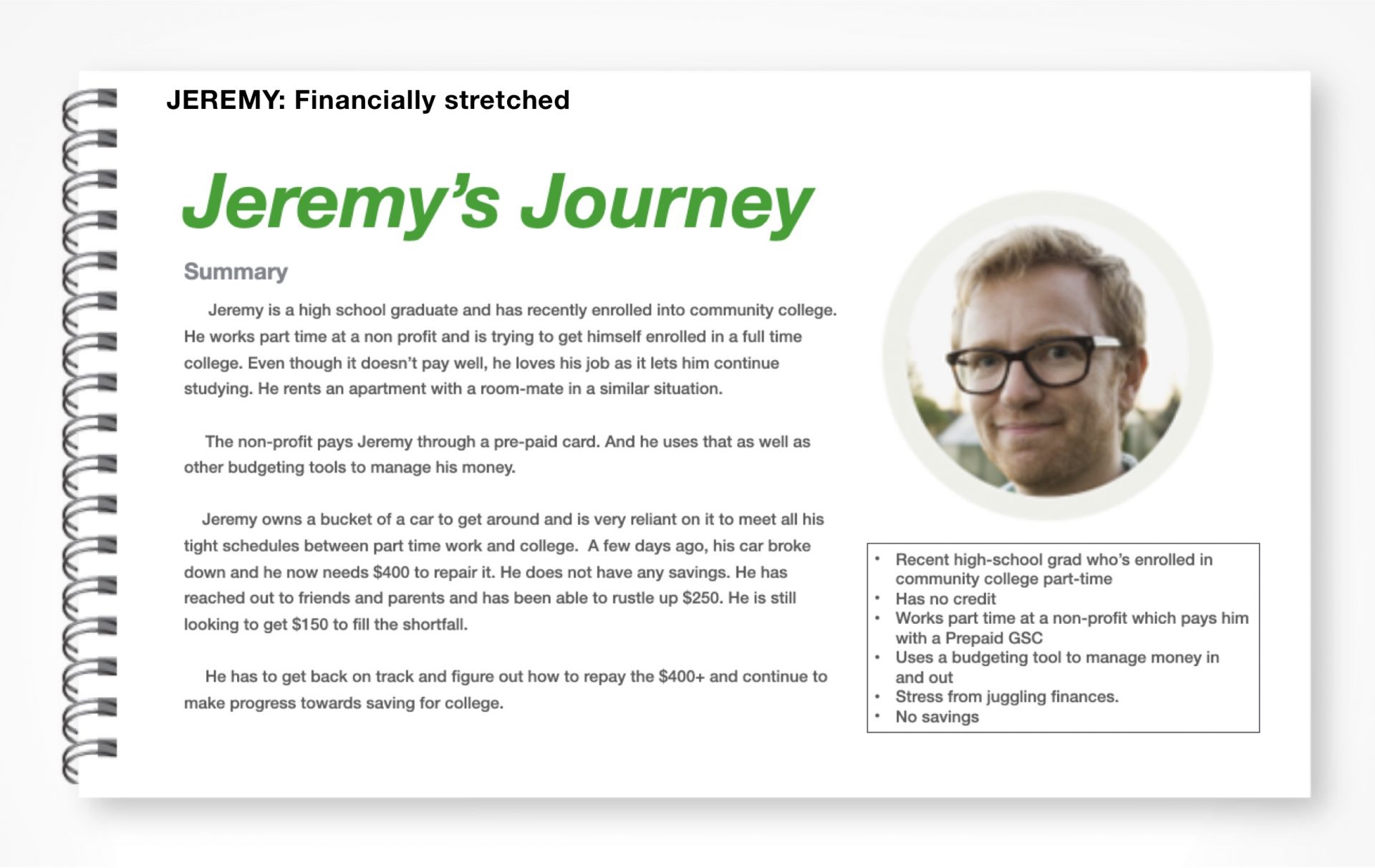

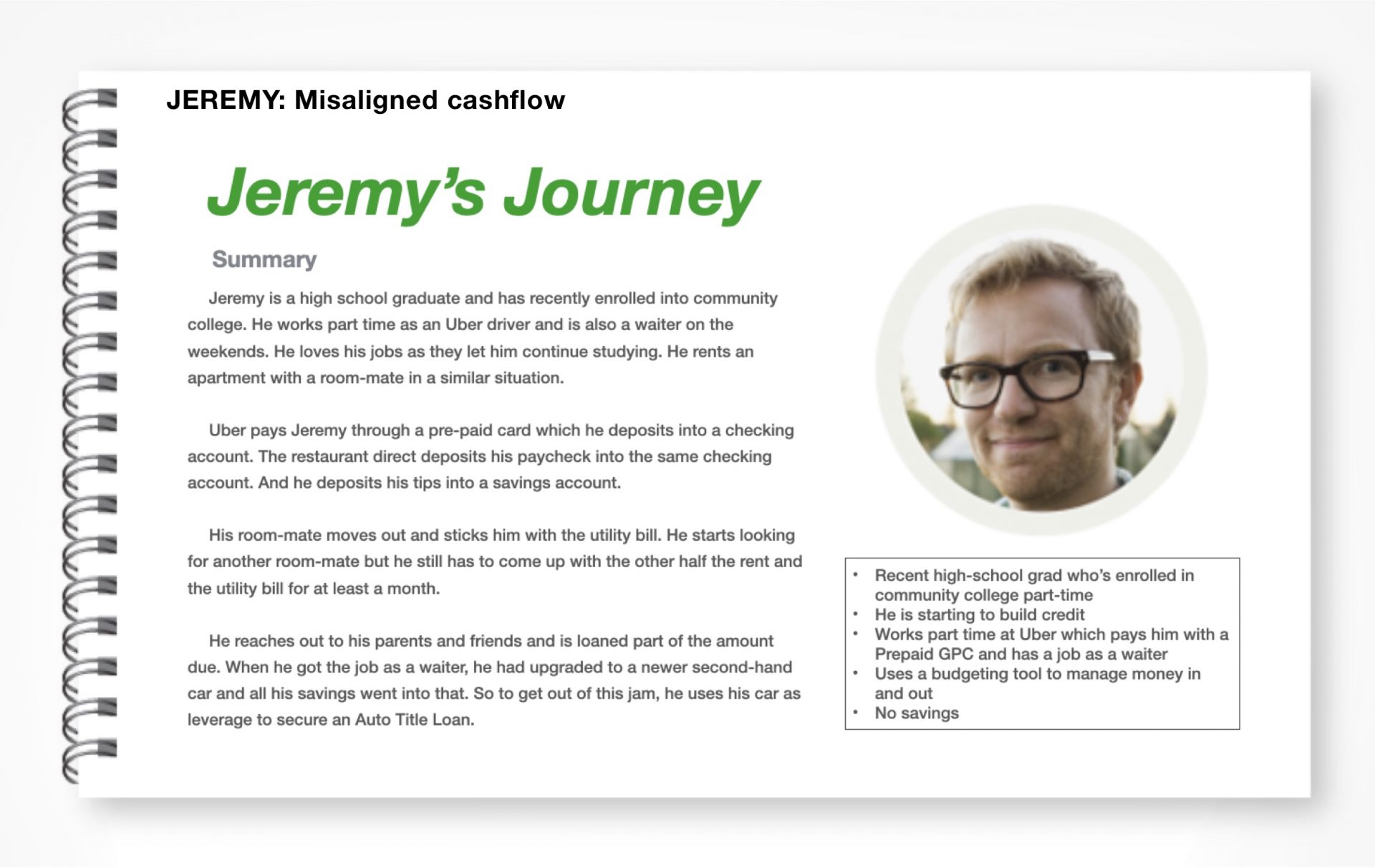

• Jeremy: Taking control. Financial literate, but requires PFM tools to monitor money in/ out to track spending and avoid fees.

r

2C. OBJECTIVES

With our core personas in place, our next step was creating narratives and journeys to gain a deeper understanding of context and the unique challenges, needs and opportunities facing the Underbanked.

r

2D. CUSTOMER SEGMENT: Financially stretched

• Dylan: struggles with seasonal income and lack of credit. He’s resigned to debt and is focused on meeting financial obligations. Unexpected expenses mean bills and remittances back home don’t get paid.

• Natalie: recently divorced and is focused on rebuilding her credit. Faced with unexpected expenses she takes out a pay day loan which took her 6 months to pay off.

• Jeremy: as a college student, he’s reliant on his car for work to make ends meet. When his car breaks down he is forced reach out to family and friends for a loan.

R

r

2E. CUSTOMER SEGMENT: Misaligned Cashflow

• Dylan: struggles with seasonal income and lack of credit. In order to pay bills, Dylan has been forced to resort to pay day loans to pay bills until he has income.

• Natalie: is rebuilding her credit, and faced with money and out gaps. She looks at creating an easy to follow envelope type approach to savings to ensure that is money is unhand for monthly bills.

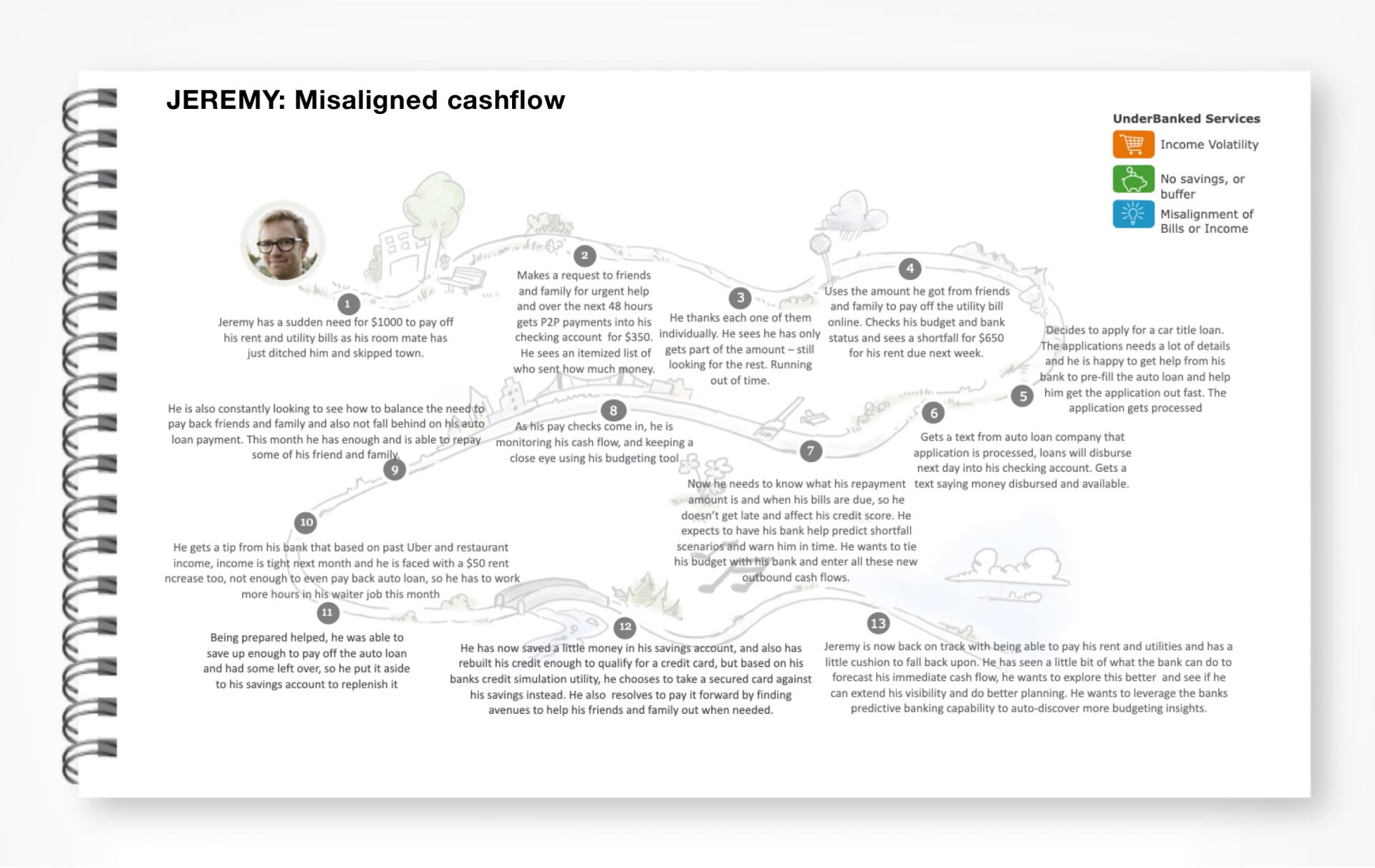

• Jeremy: is a college student. When his room mate bails on him and sticks him with rent, he is forced to take out a auto title loan to cover the shortfall.

R

r

2F. INSIGHTS: Customer needs and challenges

• Financially stretched: Face with unexpected expenses and lacking in access to financial products and services many of the underbanked resort to pay loans and find themselves in a never ending spiral servicing these high interest loans while trying to survive.

• Misaligned Cashflow: Faced with seasonal work, or employed as a gig economy worker, the underbanked find themselves in a crunch every month struggling to pay their bills on time and avoid penalties and fees.

r

2G. NEXT STEPS

The next step was applying our shared understanding of the business impact and the underbanked customer segments to creating a Underbanked concept.

r

02 EXPLORE: Imagine and validate the experience

r

With a shared understanding of the business impact and the underbanked customer segments, target audiences and their core needs, challenges and opportunities we were ready for the final workshop to rapid prototype the Underbanked concept.

R

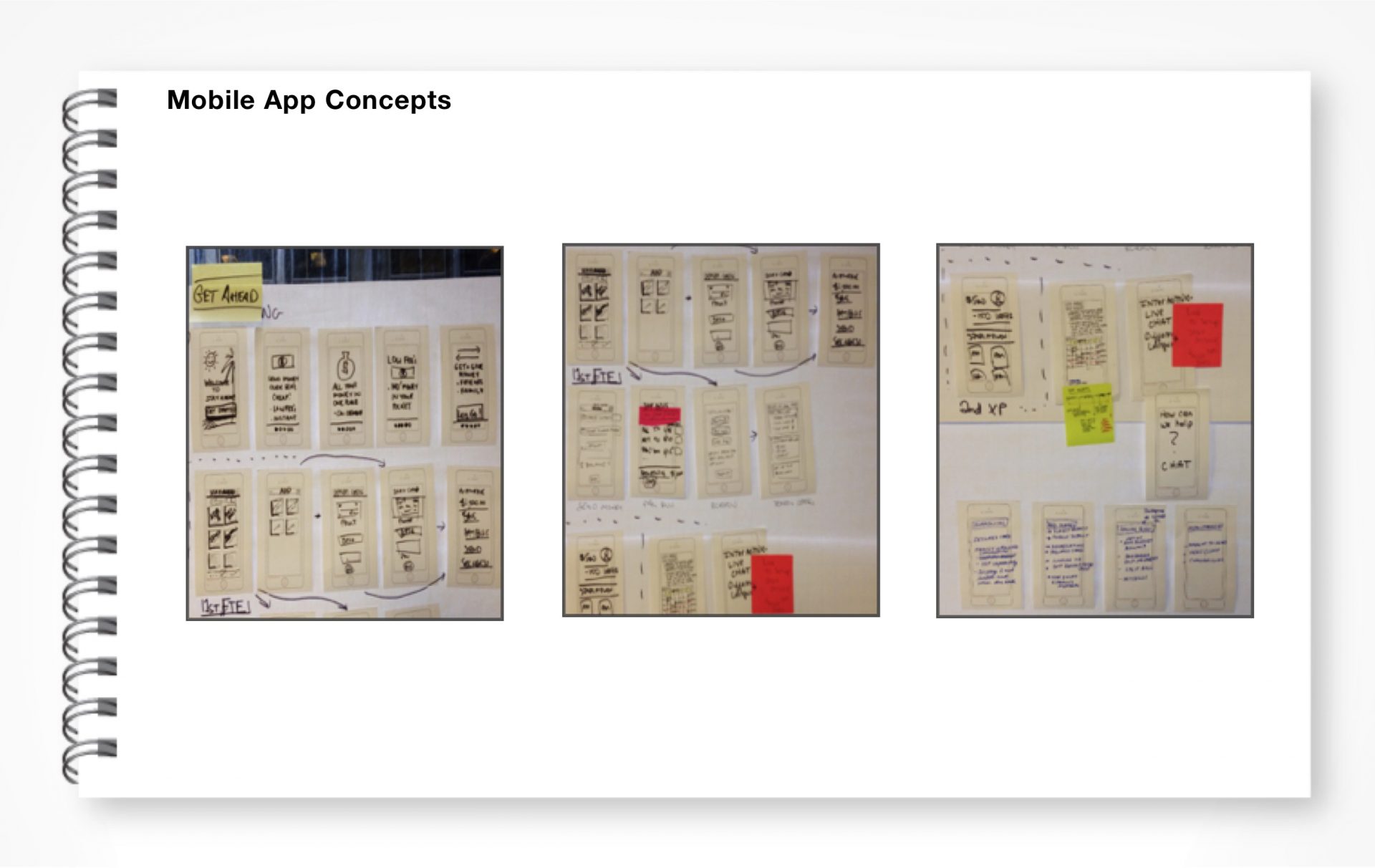

1. WORKSHOP: Underbanked rapid prototyping

R

Final workshop to prototype the Underbanked concept.

r

1A. FORMAT

Protothon: All day workshop, held with 50 participants from the various lines of business and compliance at Wells Fargo that would be involved and impacted by products and services for the Underbanked.

• Consumer banking digital strategy

• Customer experience: strategy and user raesearch

• Consumer banking customer experience

• Savings and loans

• Consumer deposits

• Compliance

• Agency of record for the Underbanked market research

r

1B. OBJECTIVE

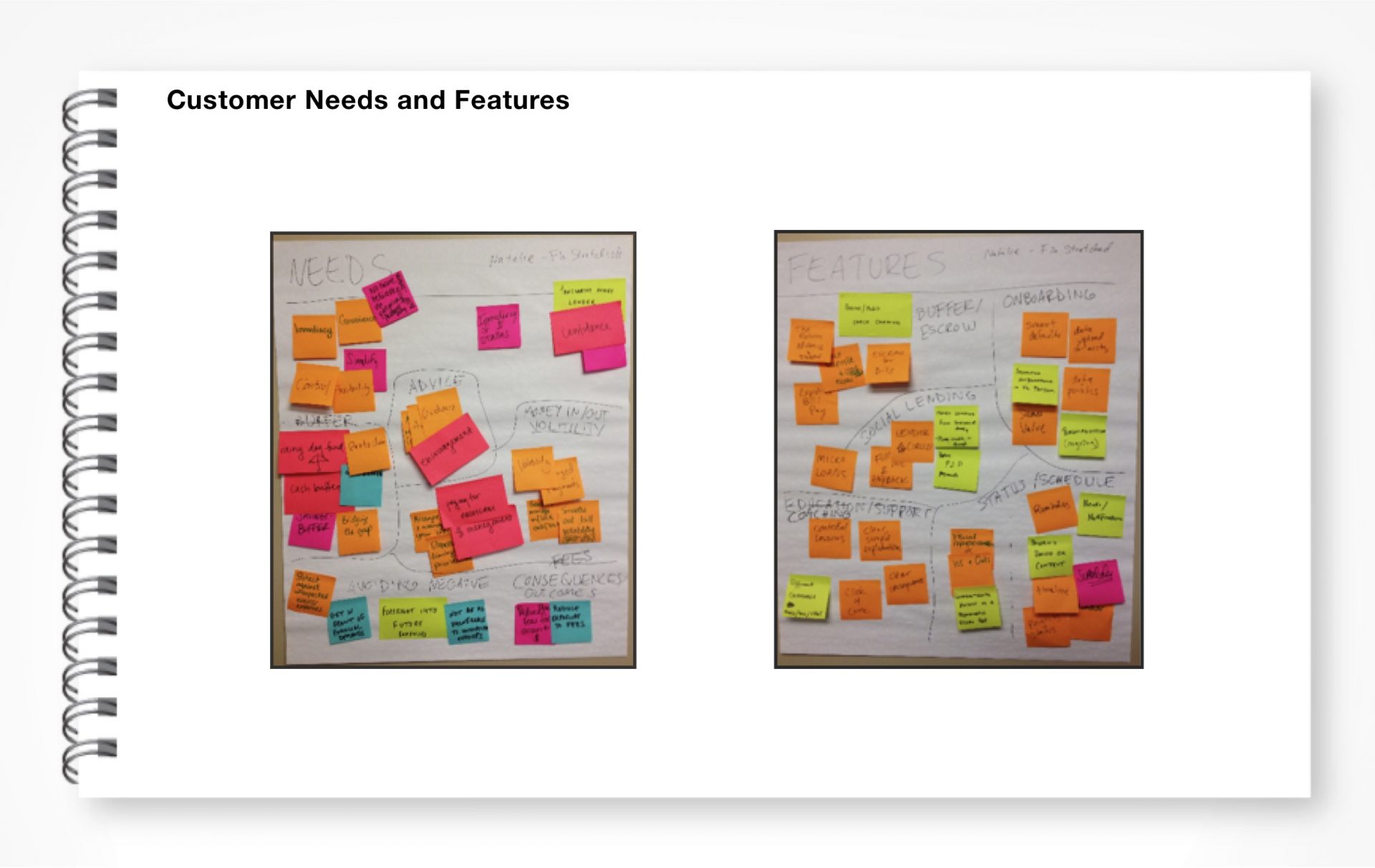

Create a series of paper prototypes that could be collapsed into a features matrix which would be prioritized for the concept development and testing.

• Affinity mapping: Customer needs and features for financially stretched and

• Concept poster: High level concept/ elevator pitch

• Underbanked concept: Paper prototype based on high level concept

• Prioritized feature list: Foundation for the interactive prototype validation

r

1C. CONCEPTS

The top 3 concepts that came out of the workshop we focused on the unique needs and challenges of the primary personas.

• Dylan: Get ahead! Mobile app with assist features such as chat bot, focused on giving the user access to short term loans and allows for foreign remittances.

• Natalie: Flowt! PFM tool with money in and out dashboard.

• Jeremy: ConnectUs! Mobile app focused on peer to peer lending.

Rr

1D. COMMON THEMES AND FEATURE SETS

The 6 common themes that emerged out of the protothon:

• Visual calendar/scheduler

• Leveraging social network/ social lending

• Savings tools (safe to save)

• Onboarding show & tell

• Personalized coaching/advice

• Reinforcing good behavior

Rr

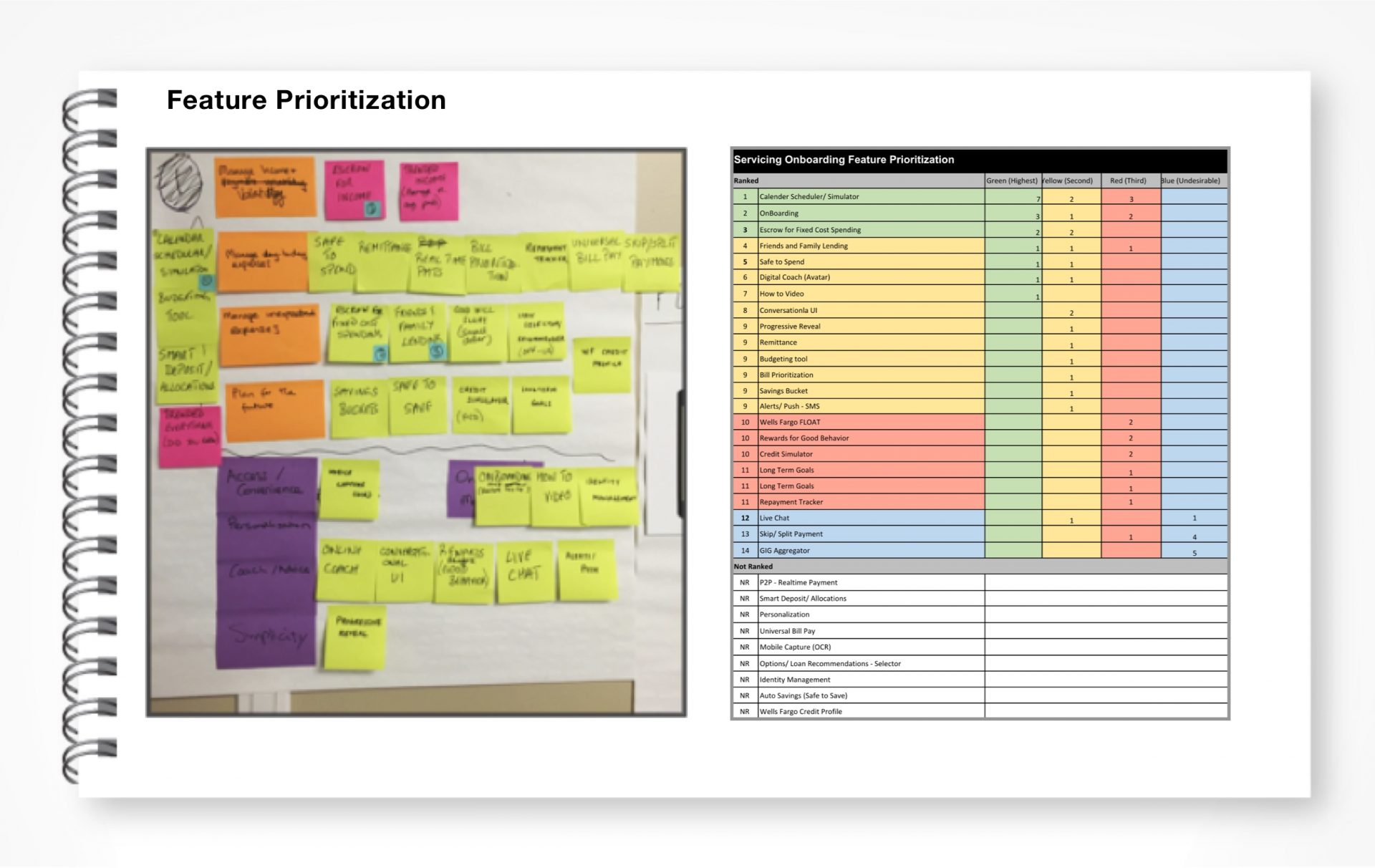

1E. FEATURE PRIORITIZATION

• Calendar scheduler/ simulator

• Safe to spend

• Onboarding

• Friends and family lending

• WF Float

• Rewards for good behavior

• Money coach

Rr

1F. NEXT STEPS

Create an interactive prototype that addresses the pain points of the Underbanked and incorporates the themes and feature prioritization established in the protothon.

R

R

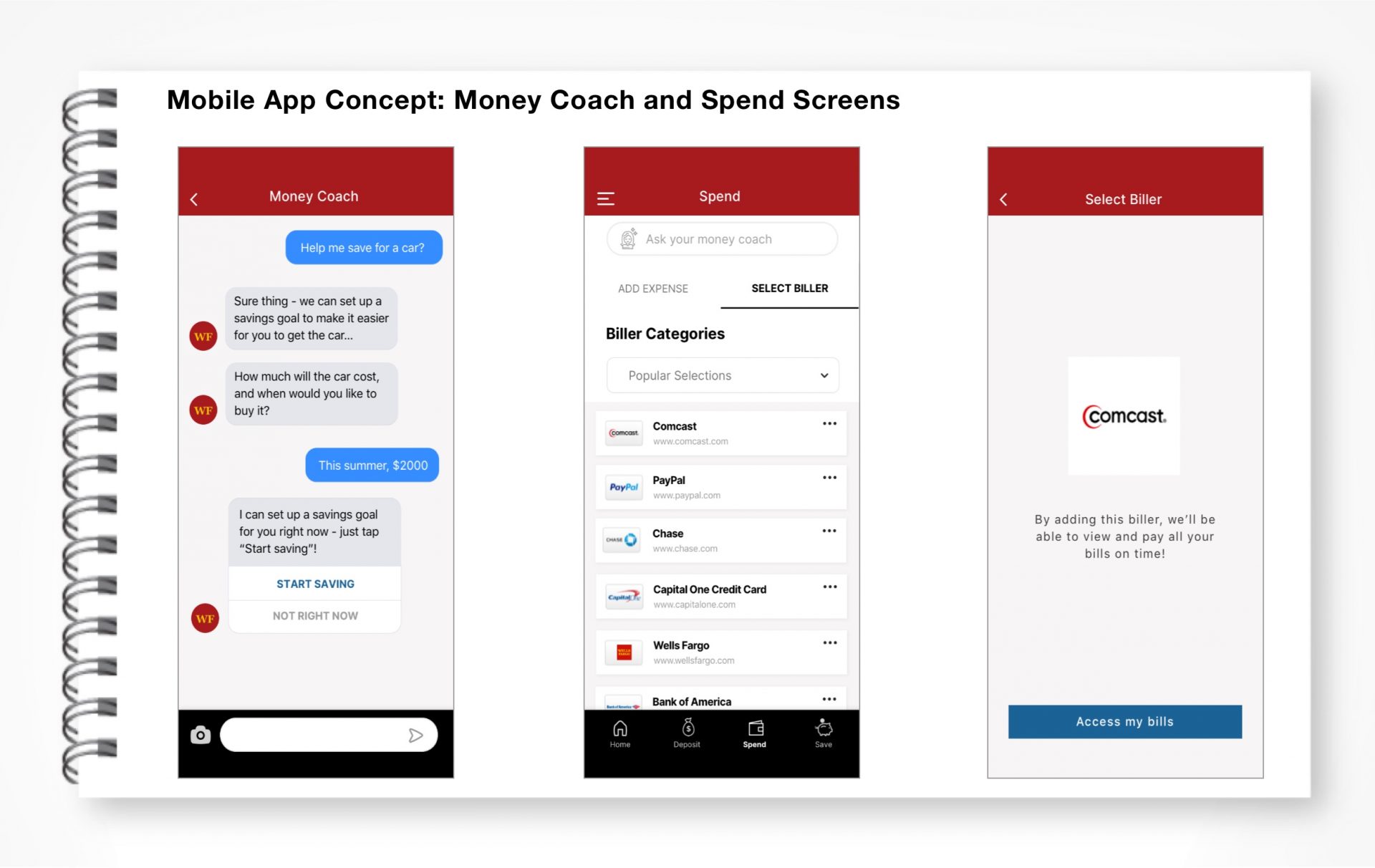

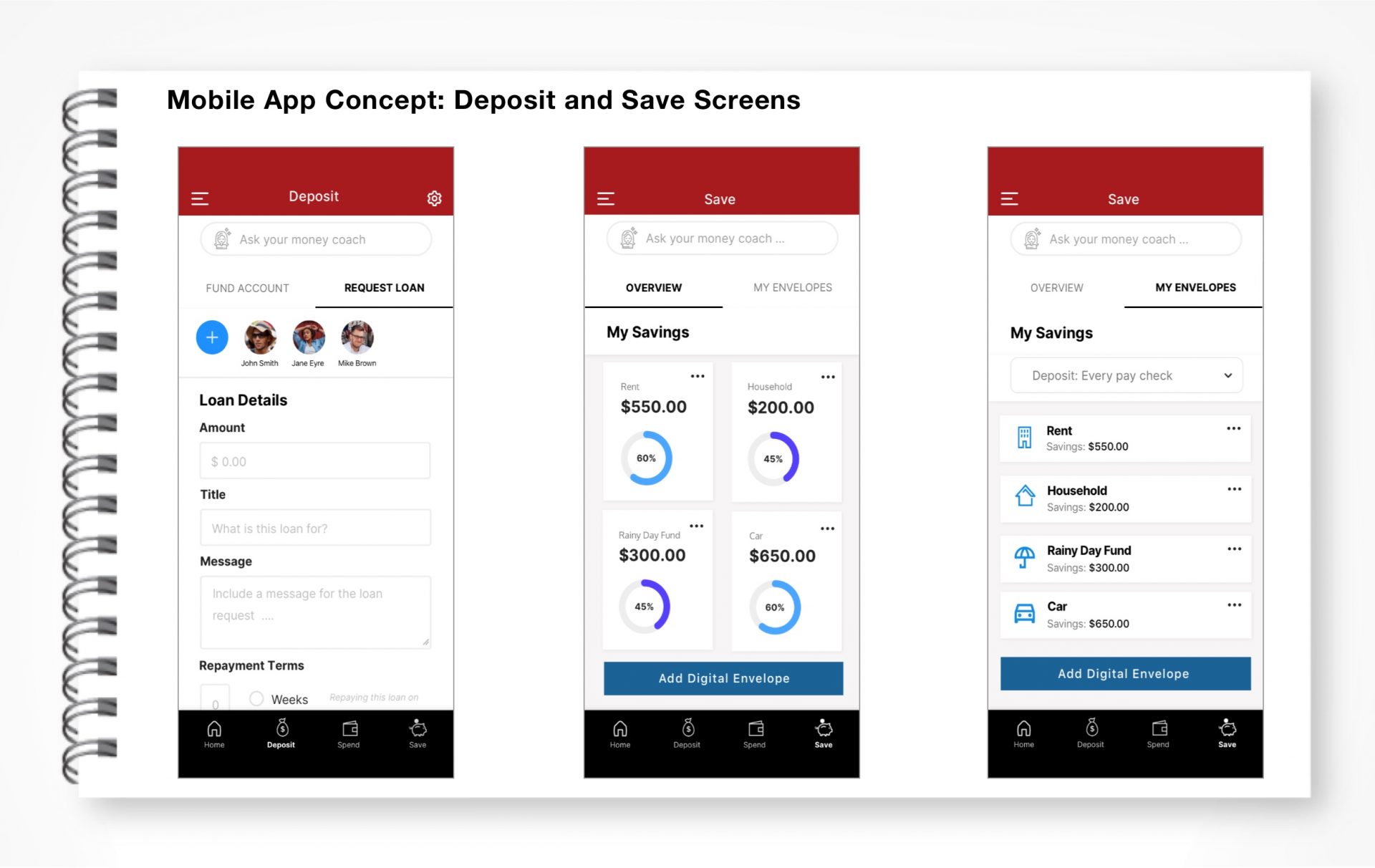

2. Underbanked prototype and validation

R

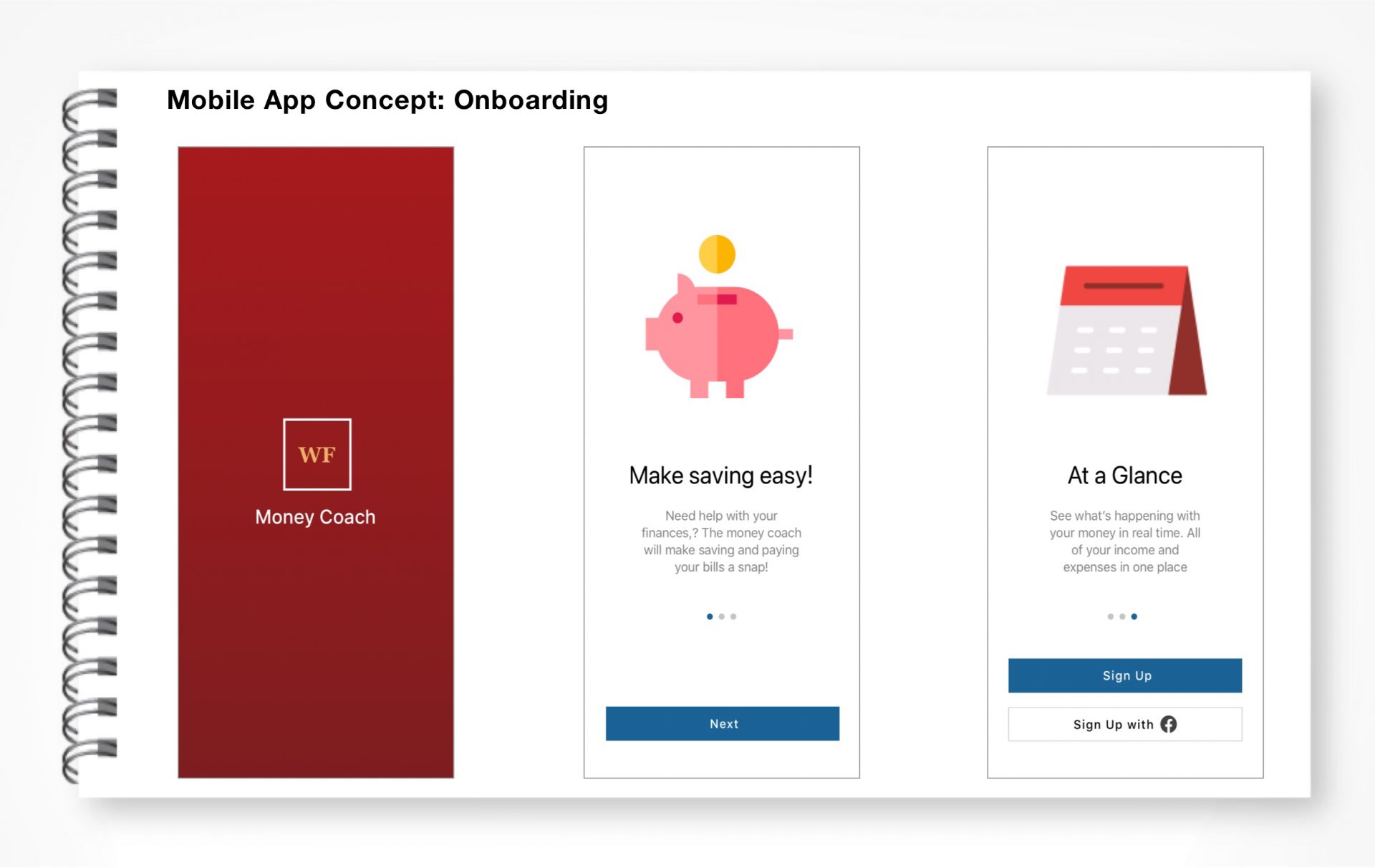

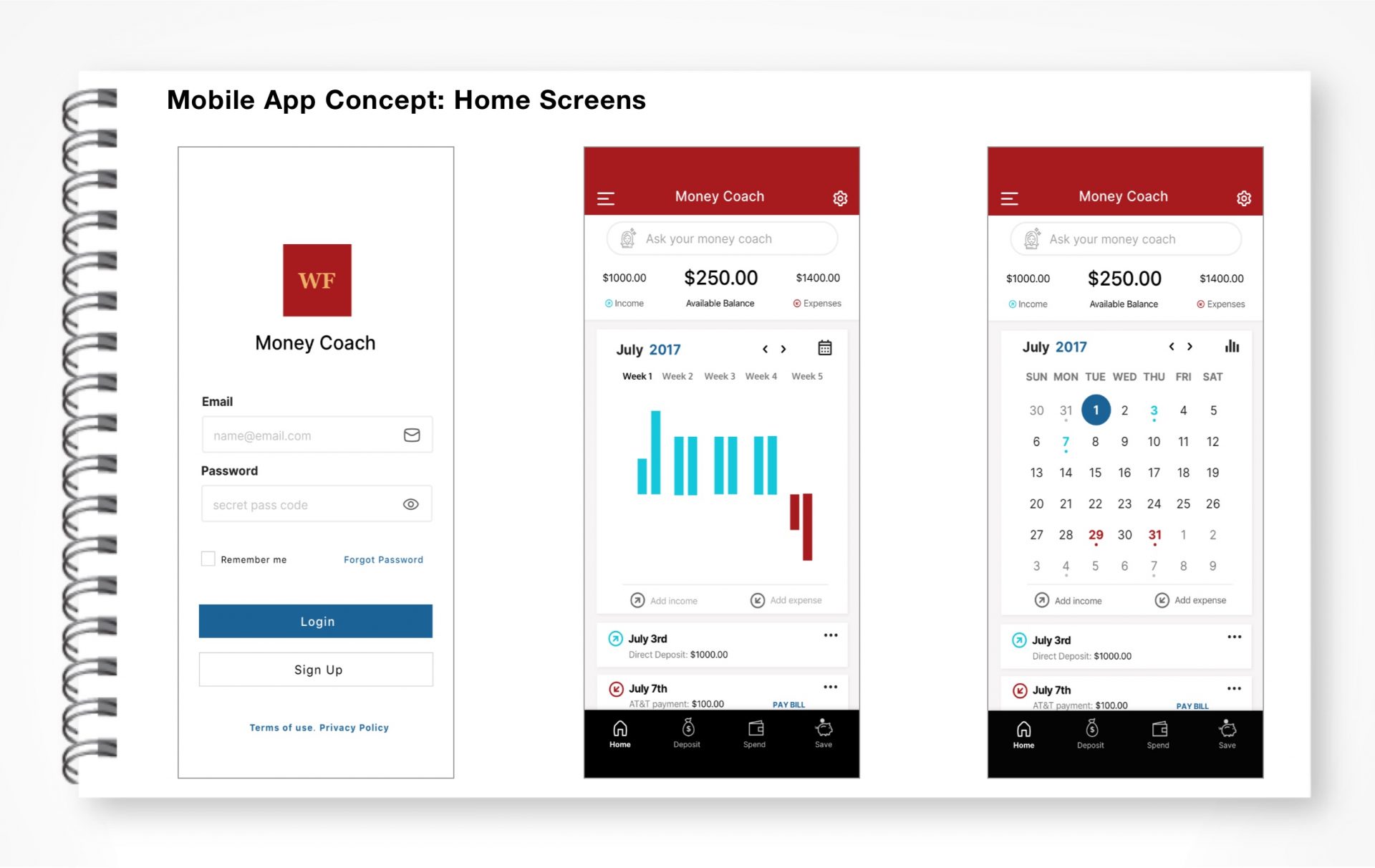

With the insights and feature prioritization from the final workshop in hand, the final step was creating an interactive mobile concept for validation. To accelerate the prototyping phase, the internal team took a 3 step approach.

r

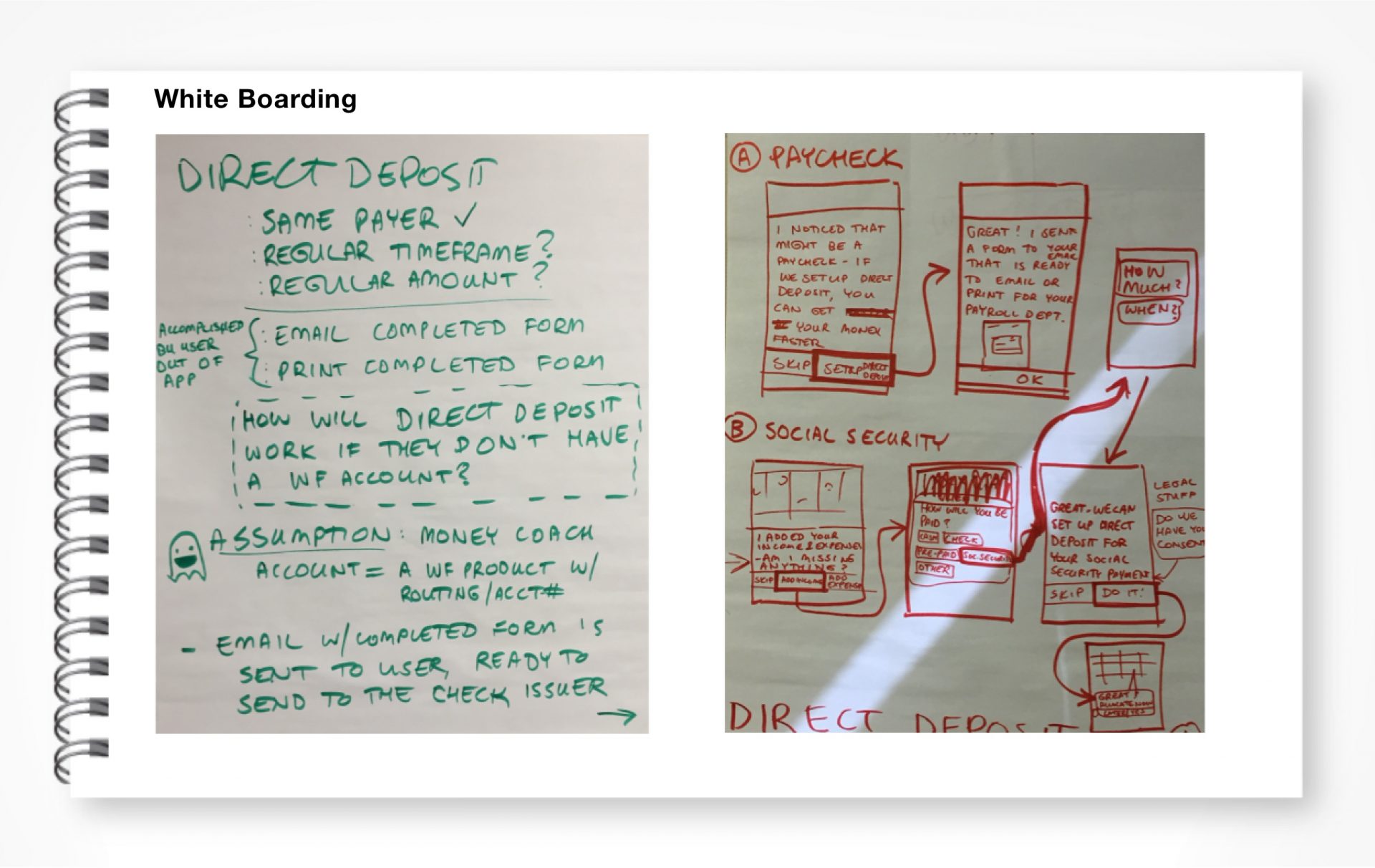

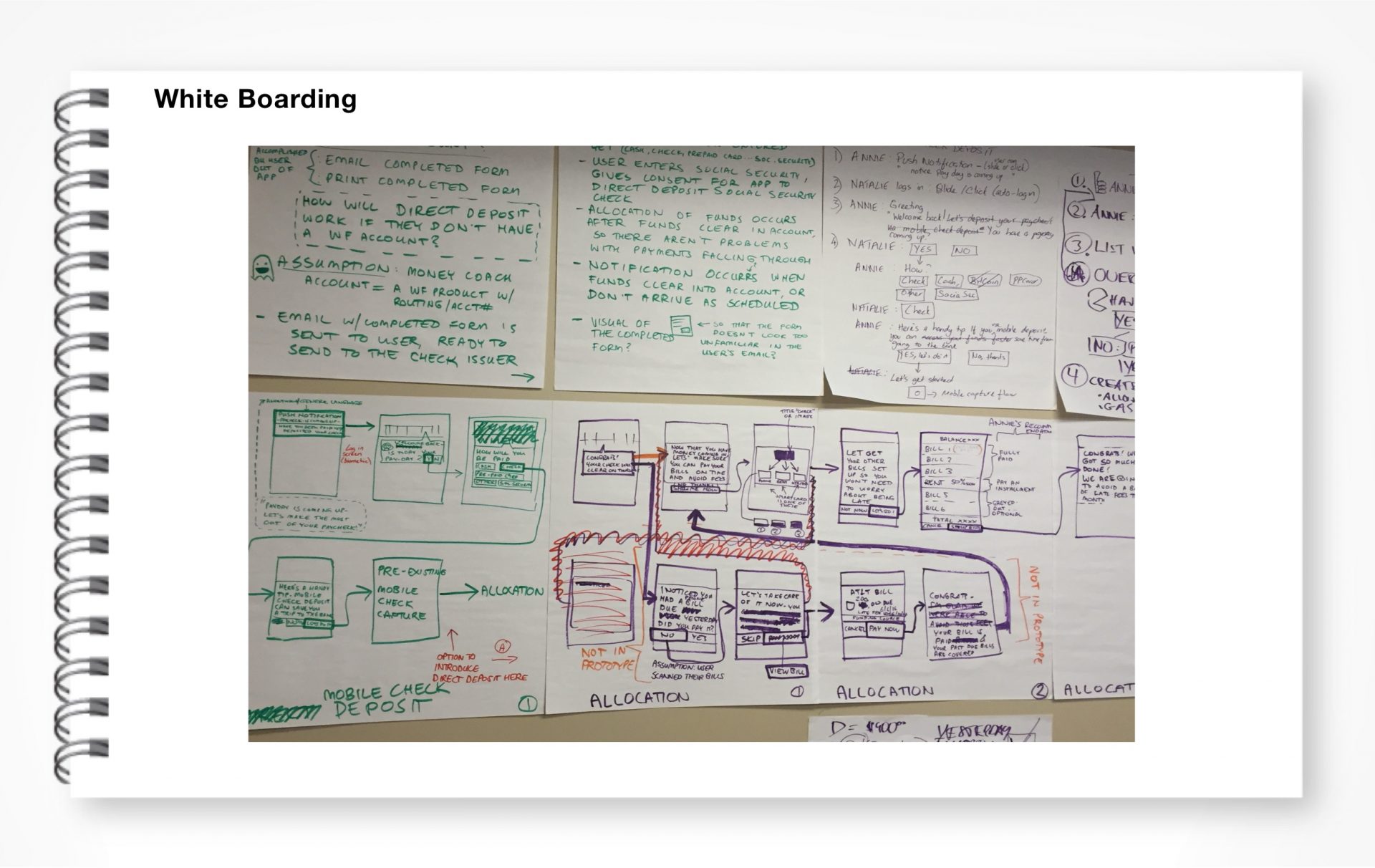

2A. WHITE BOARDING

The internal team collaborated to flush out mobile concept experience and screens that solve for the pain points of all the Underbanked personas. The tops features and experiences:

• At a glance PFM tool: money in and out

• Peer to peer lending

• Financial Guidance: Money Coach

• Envelopes for saving for unexpected and recurring expenses

r

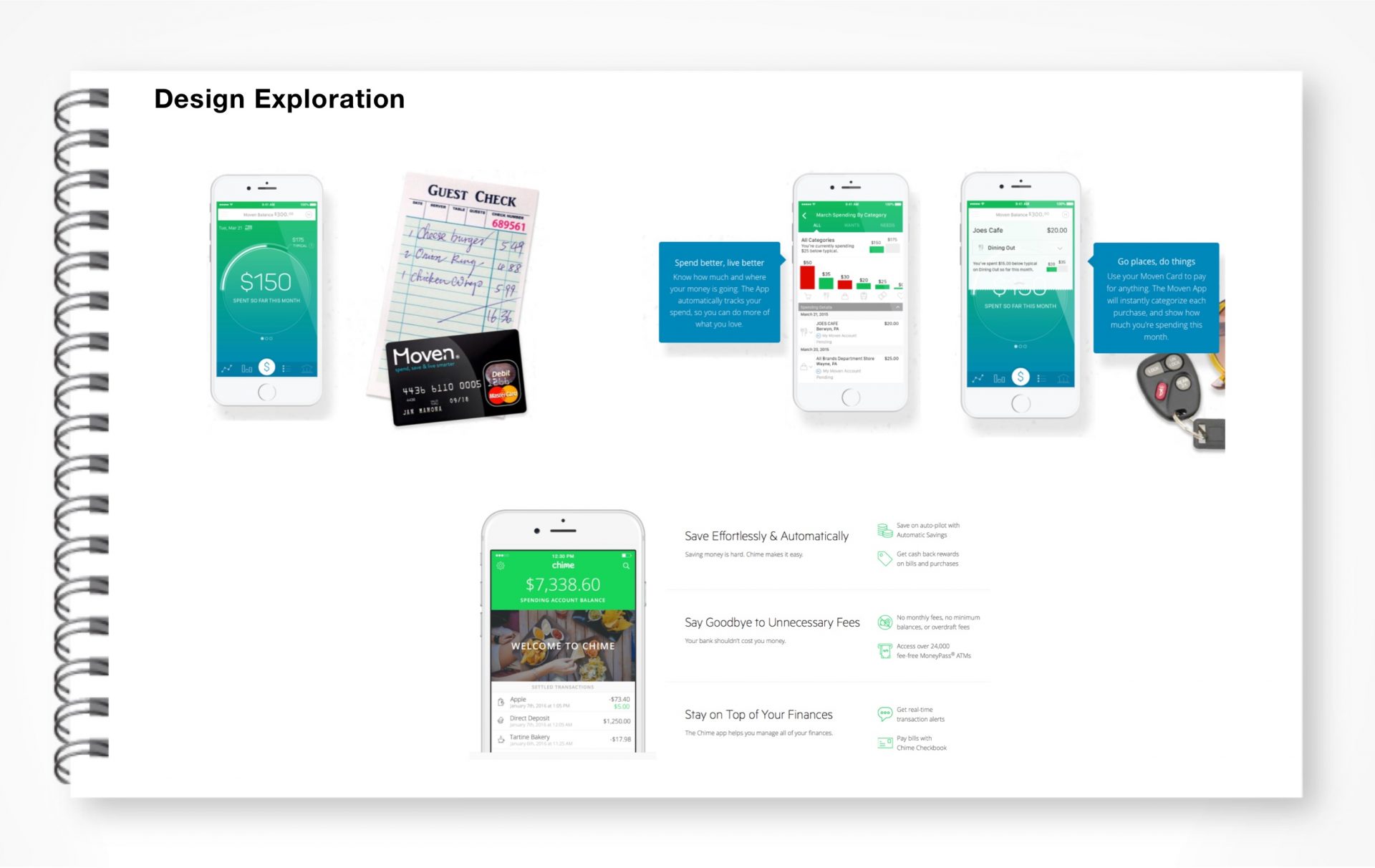

2B. EXPERIENCE AND DESIGN PATTERN EXPLORATION

• Model money in and out

• Money coach chat bot

• Peer to peer lending

• DDA: Savings

R

R

R

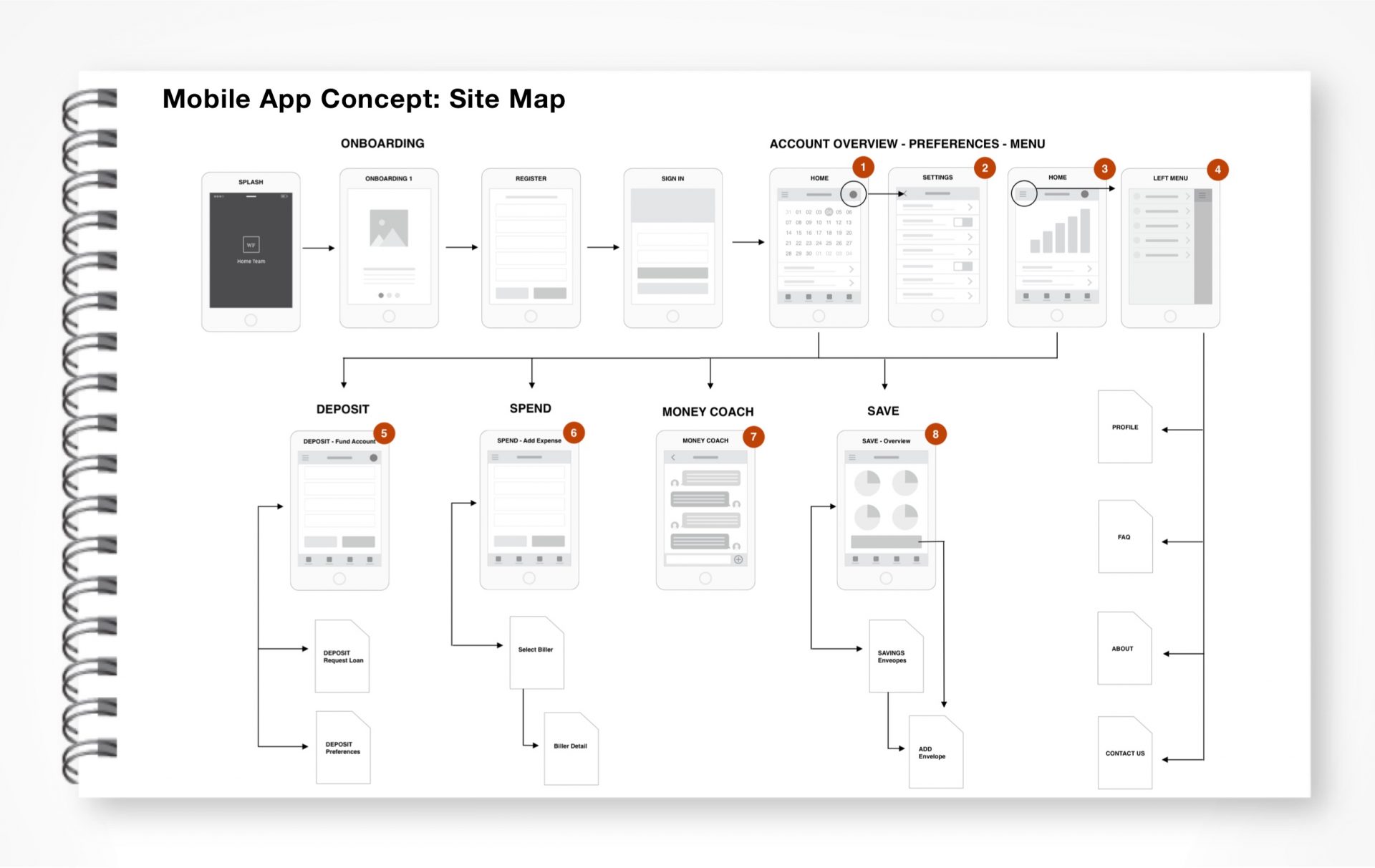

2C. INTERACTIVE PROTOTYPE

To speed review and approval by the project and leadership, I proposed using traditional interactive artifacts. These were instrumental in ensuring the internal and the project team as whole was aligned.

• User Flow

• Wireframes

• Interactive prototype

R

2D. TESTING INSIGHTS

Tested with 5 Wells Fargo clients, who had experienced intermittent financial challenges and had used pay day loans in the past

• Test participants criteria: must have at least and no more than 2 banking products. Must have used pay day loans in the last 6 months

• Features that tested most successfully were the PFM, peer to peer lending and envelope savings. The chat bot feature/ money coach was met with skepticism.

• This prototype became the baseline for future concept iterations for this pilot and would focus on employing new design patterns and components for personal finance management and P2P lending.

r

2E. NEXT STEPS

Once the initial concept was completed and validated, my role on this project concluded and I moved on to the next engagement doing opportunity and concept validation for the wealth management team!

R